Average Maintenance fee is S$ 200 - S$ 250 per monthly based on the unit type and size. The below are the Unit type and Number for your references:

Average Maintenance fee is S$ 200 - S$ 250 per monthly based on the unit type and size. The below are the Unit type and Number for your references:Click here for more New Projects

Average Maintenance fee is S$ 200 - S$ 250 per monthly based on the unit type and size. The below are the Unit type and Number for your references:

Average Maintenance fee is S$ 200 - S$ 250 per monthly based on the unit type and size. The below are the Unit type and Number for your references:

----+--------------------------------------------------------+------------+------------

Sno Name of Tenderer Tender PriceTender Price

----+--------------------------------------------------------+------------+------------

(S$m) (S$psf ppr)

----+--------------------------------------------------------+------------+------------

1Sunny Vista Developments Pte. Ltd. And Hong Realty 143.7 280

(Private) Limited

----+--------------------------------------------------------+------------+------------

2Far East Square Pte. Ltd. 129.1 252

----+--------------------------------------------------------+------------+------------

3Sim Lian Land Pte Ltd 113.0 220

----+--------------------------------------------------------+------------+------------

4First Changi Development Pte Ltd 93.4 182

----+--------------------------------------------------------+------------+------------

5Centurion Re Pte Ltd 91.9 179

----+--------------------------------------------------------+------------+------------

6UIC Commodities Pte Ltd And Chappelis Pte Ltd 90.0 175

----+--------------------------------------------------------+------------+------------

7Ho Bee Developments Pte Ltd 87.8 171

----+--------------------------------------------------------+------------+------------

8Teambuild Properties Pte Ltd 87.1 170

----+--------------------------------------------------------+------------+------------

9Allgreen Properties Limited 87.0 170

----+--------------------------------------------------------+------------+------------

10Hoi Hup Realty Pte Ltd And Sunway Developments Pte Ltd 86.6 169

----+--------------------------------------------------------+------------+------------

11Boon Keng Development Pte Ltd 81.2 158

----+--------------------------------------------------------+------------+------------

12JBE Development Pte Ltd 78.5 153

----+--------------------------------------------------------+------------+------------

13Frasers Centrepoint Limited 77.0 150

----+--------------------------------------------------------+------------+------------

Supply-oriented measures becoming more likely. This reaffirms our view that a supply-oriented measure now appears more likely than a demand-oriented one, which should only be implemented when speculation is excessive and not when the economy and property sector have just started to recover. The figure above shows some of the expected launching projects.

Supply-oriented measures becoming more likely. This reaffirms our view that a supply-oriented measure now appears more likely than a demand-oriented one, which should only be implemented when speculation is excessive and not when the economy and property sector have just started to recover. The figure above shows some of the expected launching projects. What's more, developped by NTUC Home Choice, NTUC members enjoy special benefits when you purchase a unit in Trevista.

What's more, developped by NTUC Home Choice, NTUC members enjoy special benefits when you purchase a unit in Trevista. How to Make Million$ in Property Investments

How to Make Million$ in Property Investments

Pretty fast. We shall see if the IR can really help Singapore boost its economic to the next level.

Pretty fast. We shall see if the IR can really help Singapore boost its economic to the next level. Supply glut has been overstated. The tight supply in the public housing segment, which accounts for 78% of the total housing stock, and the segment's narrow price differential with the private mass market segment support the overall private residential market. Moreover, the demand and supply dynamics are favourable to the private mass market and mid-tier segments that constitute nearly 80% of the private housing market. Also, the strong holding power of developers this time round lends them greater flexibility in releasing their high-end inventories.

Supply glut has been overstated. The tight supply in the public housing segment, which accounts for 78% of the total housing stock, and the segment's narrow price differential with the private mass market segment support the overall private residential market. Moreover, the demand and supply dynamics are favourable to the private mass market and mid-tier segments that constitute nearly 80% of the private housing market. Also, the strong holding power of developers this time round lends them greater flexibility in releasing their high-end inventories.

----------------+-------------------+------------------------

Viva Madison Residences

----------------+-------------------+------------------------

Developer All Green Keppel land Realty Pvt

Properties Ltd Ltd.

----------------+-------------------+------------------------

Location District 11 Near District 10, 335, Bukit

Novena Mrt Timah Road

----------------+-------------------+------------------------

Region Central Core Central Core Region(CCR)

Region(CCR).

----------------+-------------------+------------------------

Tenure Freehold Freehold

----------------+-------------------+------------------------

Type Condominium Condominium

----------------+-------------------+------------------------

Estimated TOP 2013 2013

date

----------------+-------------------+------------------------

Total Units 235 units 18 storey residential

with 56 units

----------------+-------------------+------------------------

Launch date Aug 8th Aug 7th ?preview

----------------+-------------------+------------------------

Takeup 85% of launched 25% of previewed units

units

----------------+-------------------+------------------------

Avg Price S$1500 psf S$1650 psf

(S$psf)

----------------+-------------------+------------------------

Expected yield 3 - 3.5% 3 - 3.5%

----------------+-------------------+------------------------

Viva @ Novena

Viva @ Novena Madison Residences

Madison Residences Studio – 474/484 sq.ft. ( 44 units )

Studio – 474/484 sq.ft. ( 44 units ) Centro Residences

Centro Residences These suggest that primary home take-up rates remain strong, even with launch prices close to last cycle’s peak prices. The availability of low mortgage rates is keeping investor interest high. Interestingly, valuation mismatches and weak rental yields seem to be stalling secondary market momentum, while banks are now offering valuations that are 10-12% lower than asking prices. We remain of the view that Singapore home-price momentum will stall.

These suggest that primary home take-up rates remain strong, even with launch prices close to last cycle’s peak prices. The availability of low mortgage rates is keeping investor interest high. Interestingly, valuation mismatches and weak rental yields seem to be stalling secondary market momentum, while banks are now offering valuations that are 10-12% lower than asking prices. We remain of the view that Singapore home-price momentum will stall. Consist of Spacious 2, 3, 4 Bedroom Apartments and Penthouses:

Consist of Spacious 2, 3, 4 Bedroom Apartments and Penthouses:

* Located in Prime District 10, Excellent Bukit Timah Location

* Located in Prime District 10, Excellent Bukit Timah Location

* Unique, one of a kind Iconic Architectural design

* North-South Facing Single Loading Design (rare in modern condos)

* Only 2 units per storey with private lift access

* Ample carpark lots for every unit

* Outstanding Unblock Paranomic View of Bukit Timah Greenery * Within 1 km to many top schools and international institutes

* Within 1 km to many top schools and international institutes

* Near Future Art Entertainment, Esplanade and City Hall

* Near SMU and many international institutions

* 3 mins drive to Orchard Shopping Belt

* 8 mins drive to future Marina IR, Singapore Flyer and CBD

* High End Quality Finishes and Branded Appliances with every unit

Click here for more New Projects

2-Bedroom type - 840 sq ft

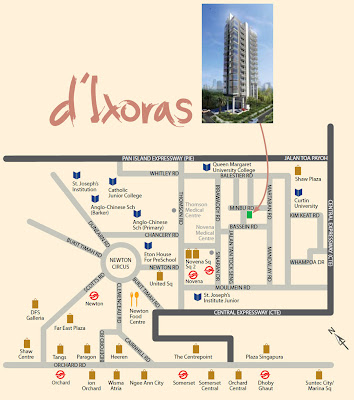

2-Bedroom type - 840 sq ft Located in Prime Novena District

Located in Prime Novena District